people's pension higher rate tax relief

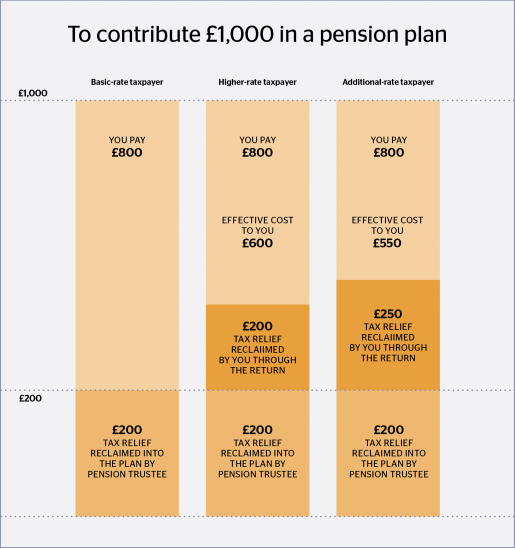

Those paying 40 income tax are entitled to 40 pensions tax relief on contributions and 50 taxpayers are entitled to 50 tax relief although this will drop to 45. 20 up to the amount of any income you have paid 40 tax on 25 up to.

Third Relief Package Of 65 Billion Euros Federal Government

And with income tax thresholds freezing until 2026 after a rise in April an estimated one million taxpayers will be drawn into these bands over the next five years which.

. The threshold for higher rate tax is 50270. Rather than what would have been the higher rate of 3375 leading to a 25. Tucked inside the 19 trillion stimulus bill that cleared the Senate on Saturday is an 86 billion aid package that has nothing to do with the pandemic.

March 7 2021. Our team of six tax. Improving Lives Through Smart Tax Policy.

You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of. American Rescue Plan Act of 2021 ARPA The United States has provided about 6 trillion in total economic relief to the. Youll be paying 40 tax on all your income over the higher-rate threshold so can claim an extra 20 on this part of your income if you pay it into your pension.

How much income tax you pay depends on what band you fall into. On 23 March which has been dubbed tax day the Treasury will announce new consultations on proposed taxation reforms which could include reforms to pension tax. This means that 12000 of all the dividend is now taxed at the new basic dividend rate of 875.

New York CPAs tax problem specialist specializing in IRS tax problems offer in compromise IRS return payroll taxes tax lien wage levy income tax tax preparation. Specifically the amount of extra tax relief you can claim depends on how much you earn over the higher rate tax band currently 50270. Fortress Tax Relief is a nationwide tax relief services company that offers assistance with all New York individual and business unpaid tax debts and back tax matters.

The combination of paying more tax and coping with a cost of living crisis could force millions of households to the brink. You can claim 20 extra tax relief on earnings you pay.

Pension Tax Relief A Payroll Bohemian Raspody

What Are The Options For Reforming Pensions Taxation Institute For Fiscal Studies

Pension Tax Relief How Some Taxpayers Can Get Extra Tax Relief On Contributions Explained Personal Finance Finance Express Co Uk

Do I Have To Join A Pension Scheme Low Incomes Tax Reform Group

![]()

Workplace Pension Provider The People S Pension

Tax Relief On Pension Contributions St James S Place

Income Tax Relief On Pension Contributions Menzies

Higher Rate Taxpayers Are Throwing Away Valuable Pension Benefits

There Is No Such Thing As Pensions Tax Relief Adam Smith Institute

Saving For Retirement What Is A Pension And How Does It Work O Leary Life

Flat Rate Pension Tax Relief Proposals Divide Experts Money Marketing

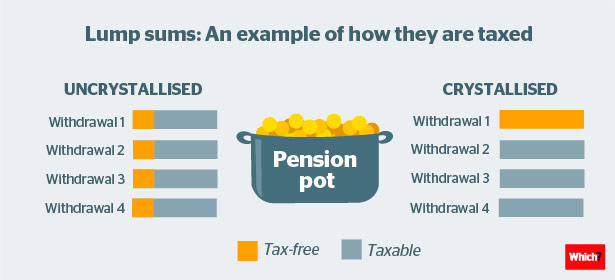

Should I Take A Lump Sum From My Pension Which

Do You Know How Tax Relief On Your Pension Contributions Works Low Incomes Tax Reform Group

Workplace Pension Participation And Savings Trends Of Eligible Employees 2009 To 2020 Gov Uk

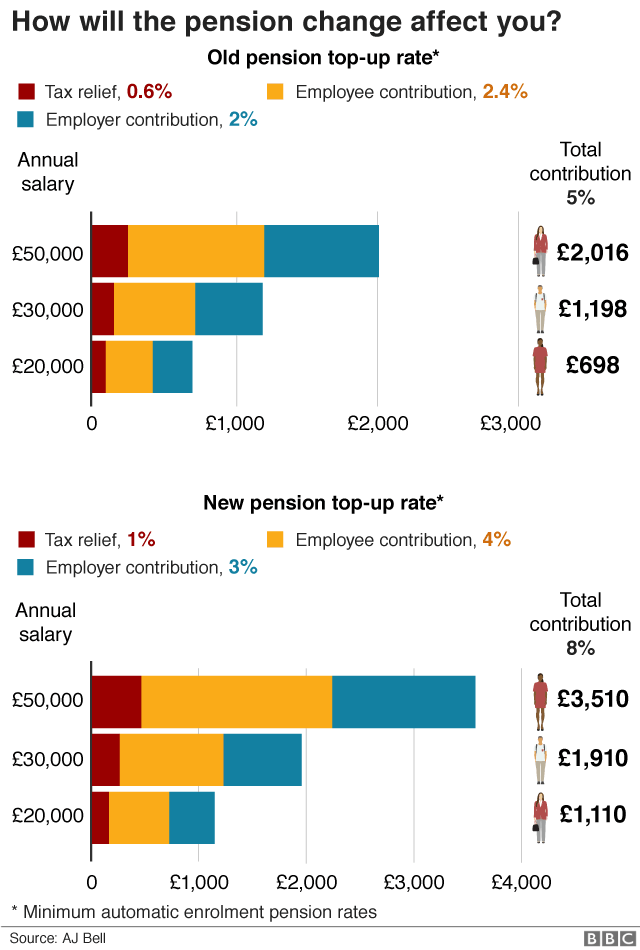

Workplace Pension Contributions The People S Pension

Self Employed Pension Tax Relief Explained Penfold Pension

How Much Can I Save Into My Pension