unrealized capital gains tax california

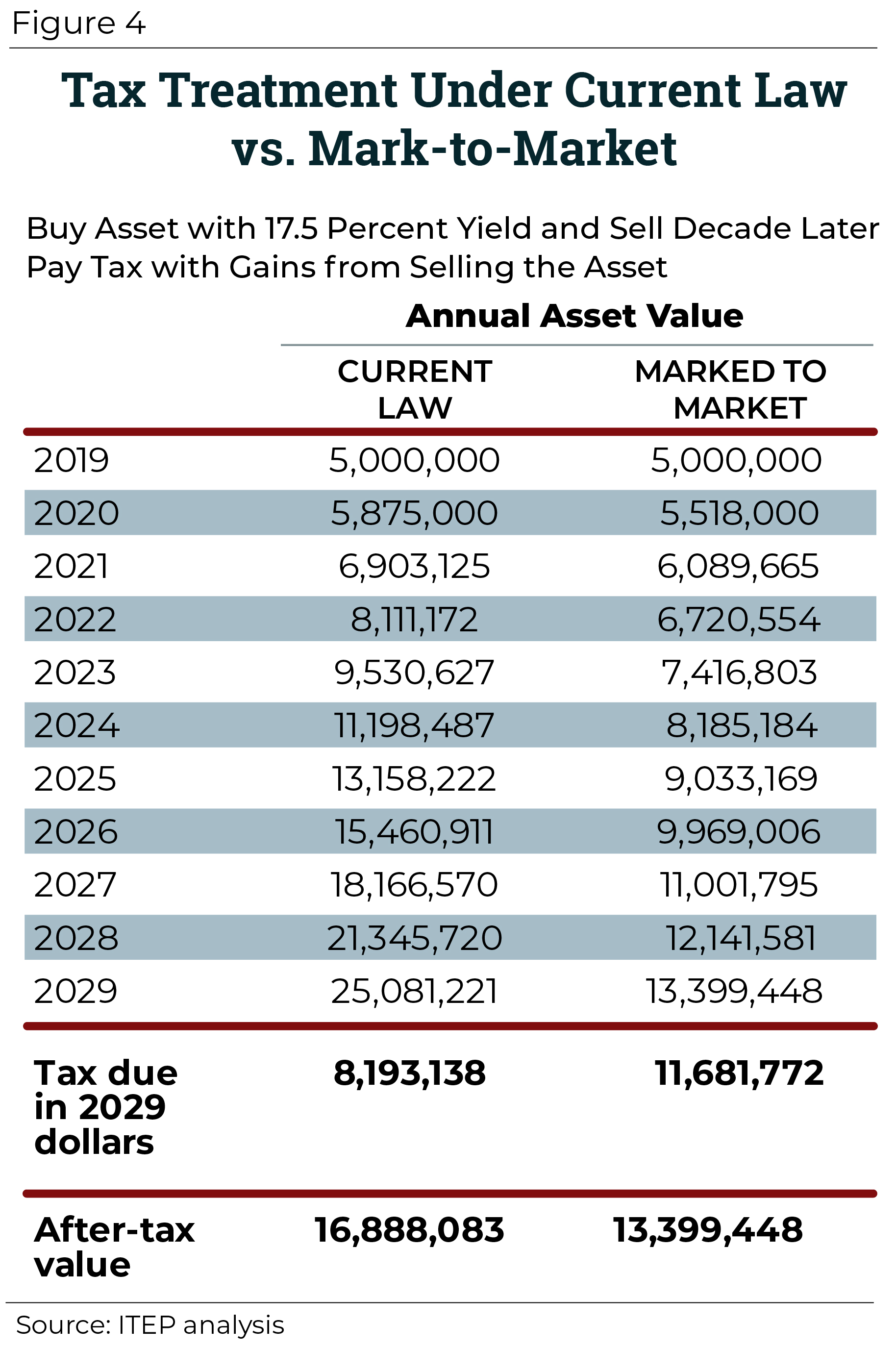

The AFP proposed raising the top capital gains rate and taxing unrealized gains at death together because raising the capital gains rate to 434 percent alone would lose federal revenue. Never sell an asset.

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

If you are referring to realized capital gains you can adjust your capital gains in the Wisconsin section.

. There is also something called the Net Investment. Actually good point. Saturday May 7 2022.

Realizations would fall so much that it would more than offset the revenue produced by the higher tax rate. If an asset is projected to make money but you dont cash in on that profit its an unrealized gain. California long term capital gain rate 133.

The Tax Benefits Of Direct Indexing Not A One Size Fits All Formula The Journal Of Index Investing. Capital gains tax could be applied to the value of securities portfolios owned by the ultra wealthy. How to report Federal return.

Unrealized capital gains are not reportable and not taxable. Most assets held for more than one year are taxed at the long-term capital gains tax rate which is. Unrealized Capital Gains Tax.

Americans oppose taxing unrealized gains by a ratio of 3-1 according to a survey experiment with 5000 respondents published in May 2021. If you have a difference in the treatment of federal and state capital gains file. Unrealized Capital Gains Tax Commit to Equity Coalition Demands CA Billionaire Tax Millionaire Tax and Additional Tax on Stock Gains August 20 2020 723 pm August 20 2020 723 pm.

Taxing unrealized Capital gains on the value of securities is rich. If you entered unrealized capital gains on federal remove them. Get The Most Out Of Employee Stock Options.

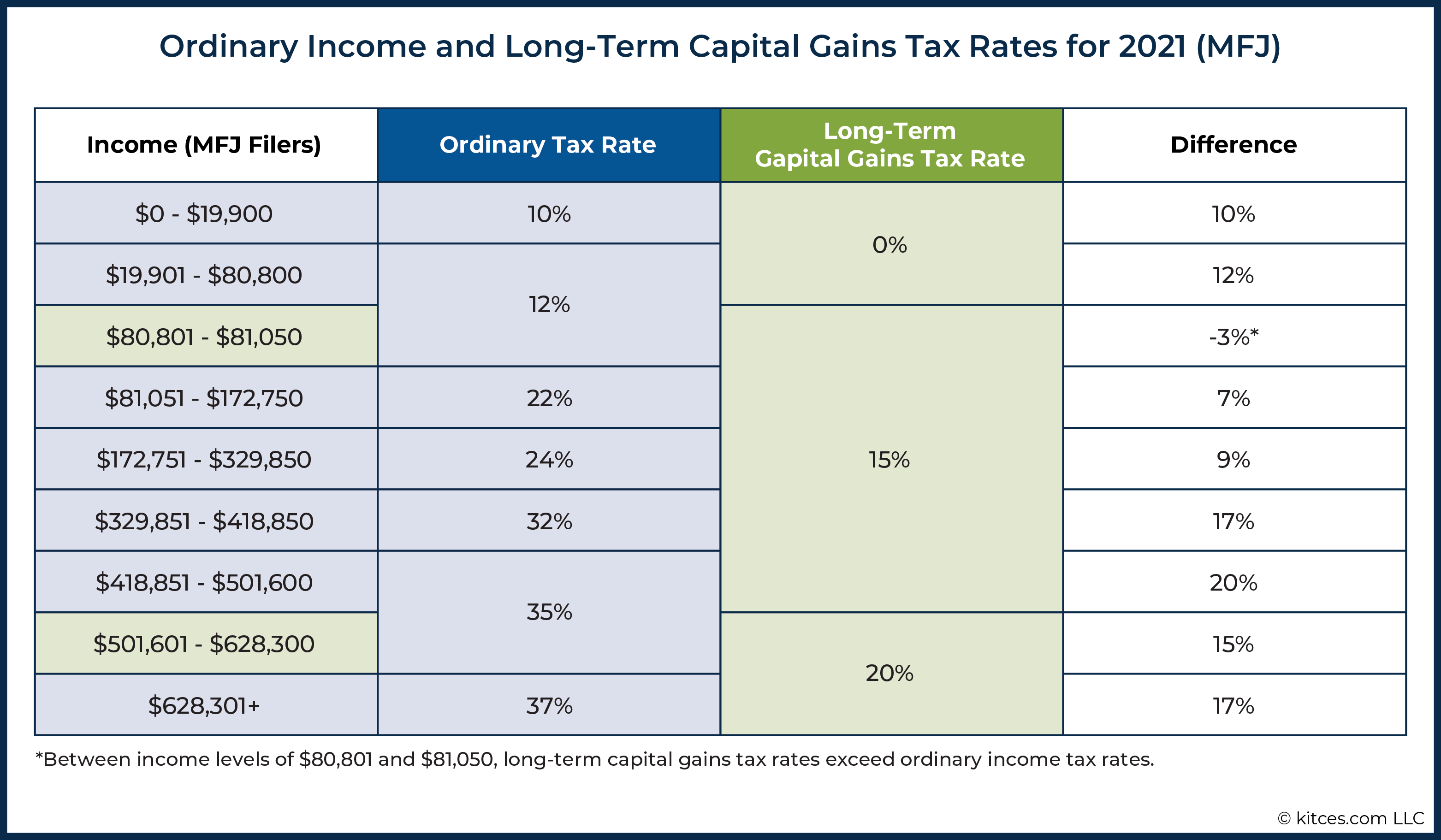

Investors may choose to sit on unrealized gains for tax benefits. You wont pay any taxes until you sell the share. High-income people also pay an additional 38 percent tax to fund health care on both earned income and investment income like capital gains so including that the top rates are 238 percent for capital gains and 408.

In California HSA accounts are treated as a normal investment account. To report your capital gains and losses use US. Unrealized gains could be very important if you invest in funds however.

The only ways to avoid paying capital gains tax are. You only have a gain or loss when you sell a stock. California is generally considered to be a high-tax state and the numbers bear that out.

To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains. Individual Income Tax Return IRS Form 1040 and Capital Gains and Losses Schedule D IRS Form 1040. California does not have a lower rate for capital gains.

Im seeing other internet articles that state that unrealized gains within the HSA are NOT taxed in CA only actual gains like dividends that are paid out capital gains if a mutual fund is sold etc. Capital gains are taxable in WI. 30 2021 Published 1040 am.

A capital gains tax is a levy on. All capital gains are taxed as ordinary income. If mark-to-market taxation of capital gains is a direct tax is not covered by the 16 th Amendment and is not apportioned then it is unconstitutional.

To answer your specific question if neither you nor the fund sells any stock then you dont report any gain or loss. There is a progressive income tax with rates ranging from 1 to 133 which are the same tax rates that apply to capital gains. Earn less than 80000 in taxable income if youre married filing jointly less than 40000 for single filers.

Americans Oppose Taxing Unrealized Gains. Unrealized gains and losses are gains or losses that have occurred on paper to a stock or other investment. Unrealized gains are not taxed by the irs.

An unrealized capital gains tax could be applied to the value of securities portfolios owned by the. Thus capital gains and losses are reported in the year in which the investment fund buys or sells the underlying stocks or bonds or funds. Without taxing unrealized gains at death the revenue-maximizing capital.

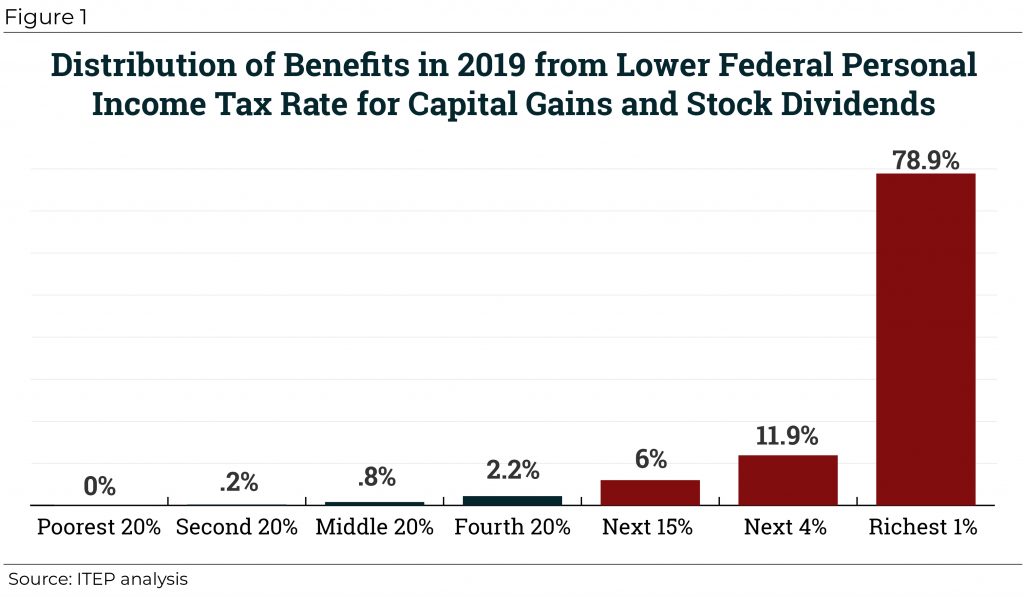

If you are in the top tax bracket your long-term capital gains tax rate would be 20 of 200 on your 1000 profit. This profit is a capital gain. Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent.

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. Unrealized capital gains tax california. To report your capital gains and losses use us.

What Does the Proposal To Tax Unrealized Capital Gains Mean for Americans. When an investor dies their assets get transferred to their heirs at the current market rate. The exact magnitude of the capital gain is 2000 gross proceeds minus 1000 cost basis resulting in a long term capital gain of 1000.

Anyone else care to chime in. Gains that are on paper only are called unrealized gains For example if you bought a share for 10 and its now worth 12 you have an unrealized gain of 2. The Golden State also has a.

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Understanding The California Capital Gains Tax

The Trouble With Unrealized Capital Gains Taxes The Spectator World

What Are Unrealized Capital Gains And Losses Bright

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Eliminate Capital Gains Tax With A Trust

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

The Billionaire Tax Proposal A No Good Awful Terrible Idea Youtube

Democrats Unveil Billionaire S Tax On Unrealized Capital Gains

Aswath Damodaran On Twitter As Increases In Tax Rates Are Taken Off The Table Taxing Billionaires On Unrealized Capital Gains Seems To Be Gaining Traction I Am Amazed By Congress S Capacity To

Capital Gains Tax Calculator 2022 Casaplorer

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Search Search Home About Our Experts Our Achievements Events Subscriptions What S New National Security Health Care Health Care Publications Health Care Commentaries Health Care Newsletters Kellye Wright Fellowship Health Policy Blog Taxes

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)